Collect payments, generate reports, and manage loan changes without chasing spreadsheets or reconciling data by hand. Everything stays accurate, automated, and in one place.

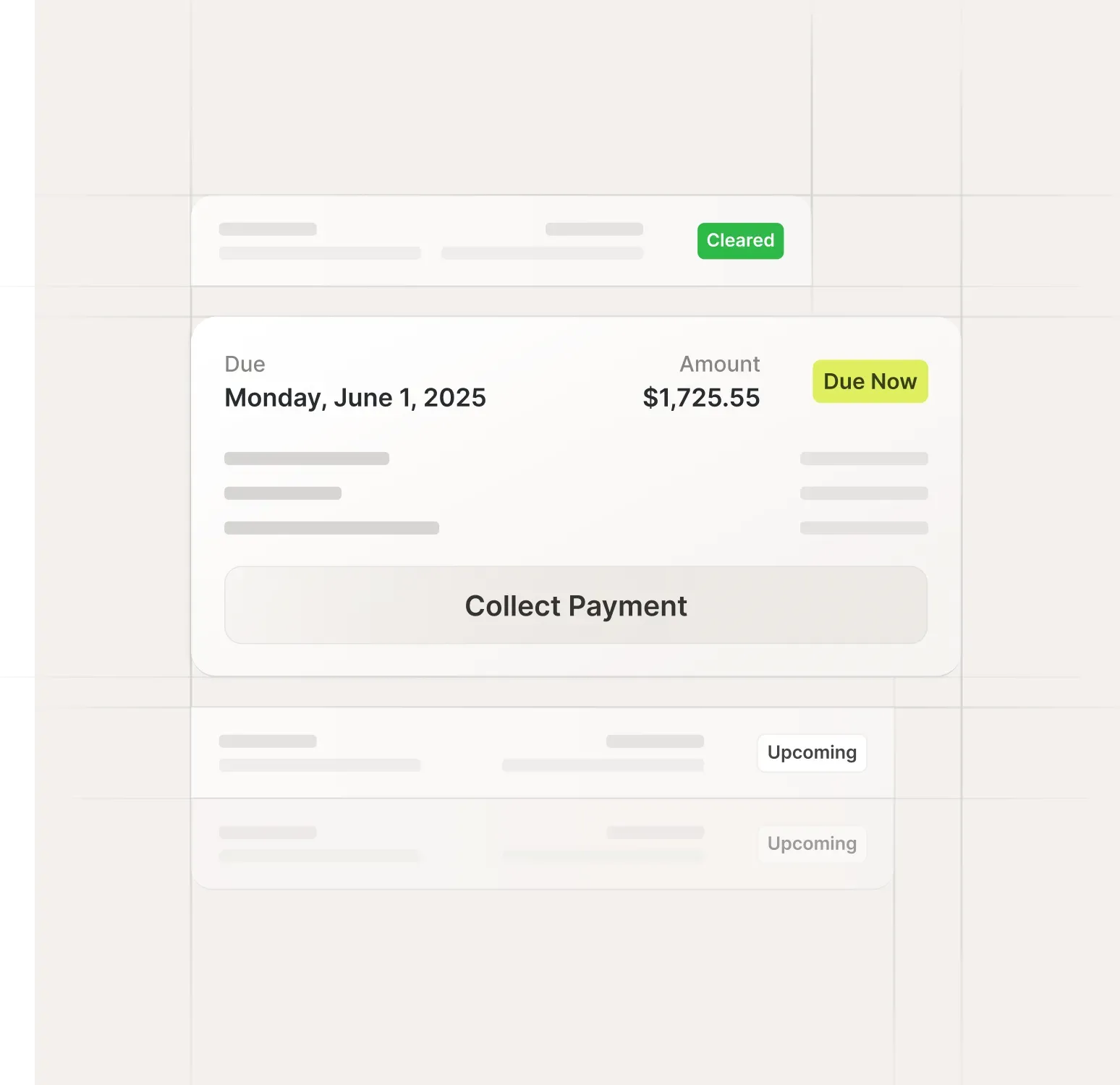

Collect ACH payments or let borrowers pay online, knowing every payment and distribution is perfectly recorded and tracked.

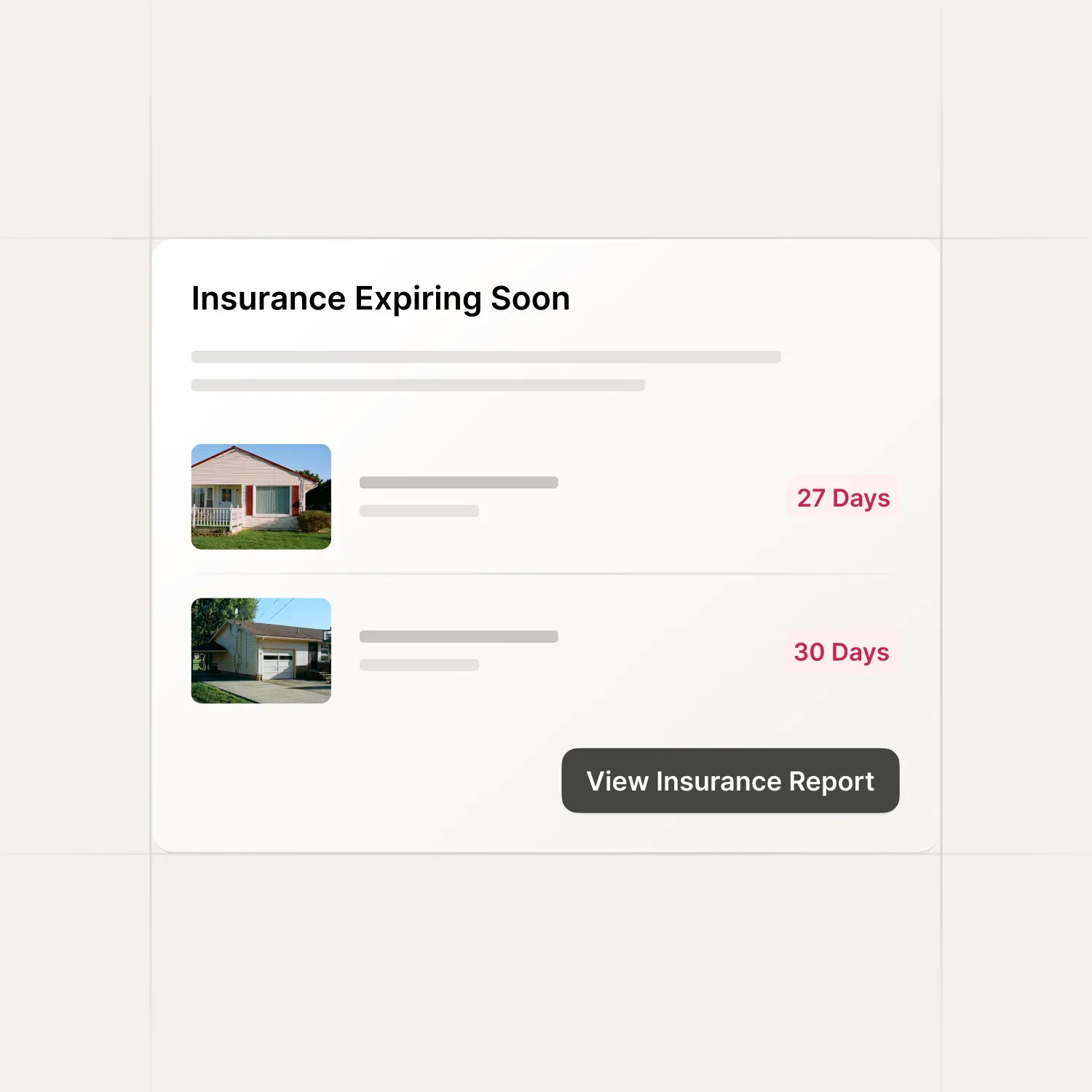

Ensure your assets are protected with detailed tracking and monitoring of critical data including tax and insurance documents.

See what’s happening across your business with real-time reports and analytics.

Payments can be tailored for every loan, then automatically calculated and queued for ACH collection—keeping everything accurate and on time.

Whatever your loan structure, Baseline is equipped to help you configure and manage your loans from funding through to payoff.

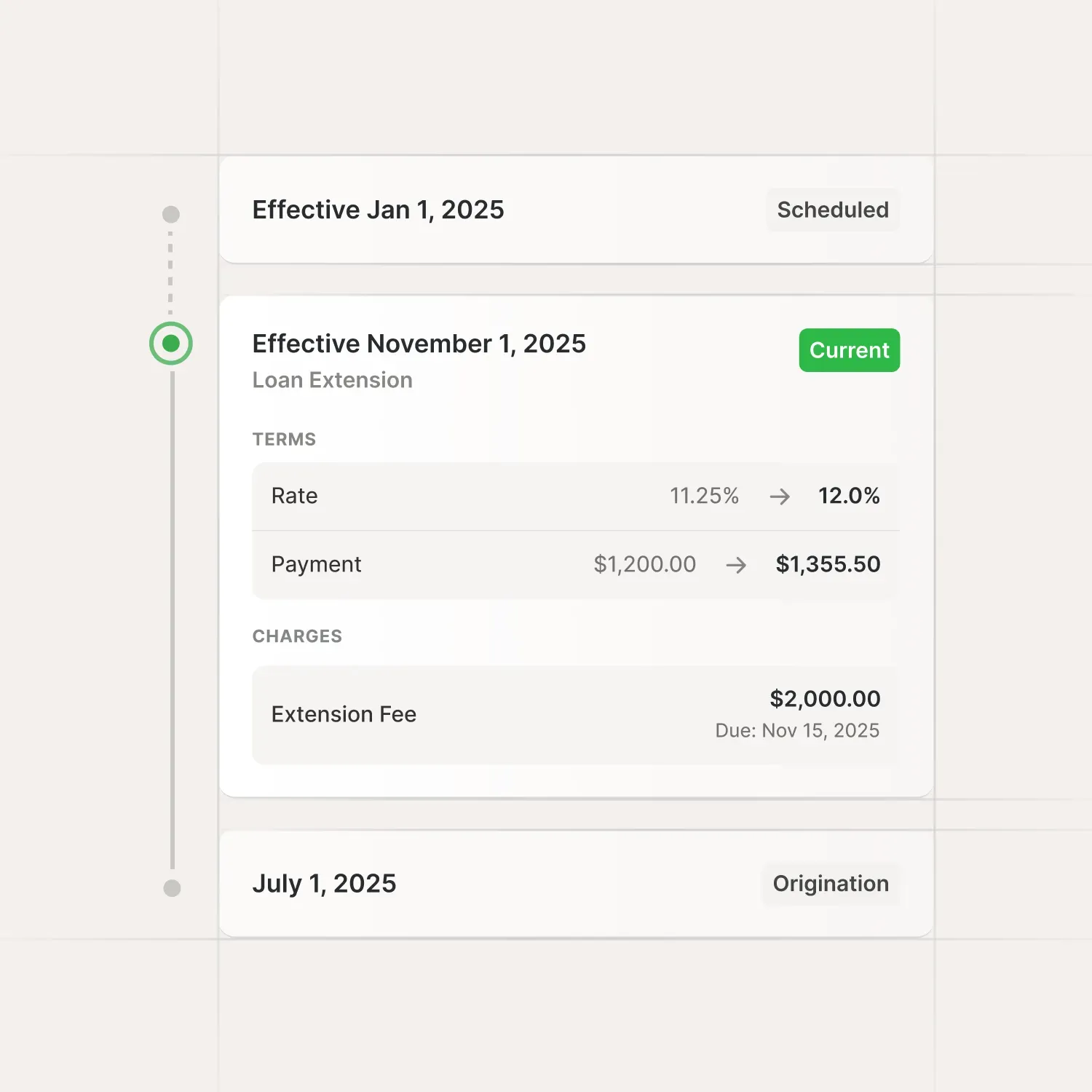

Plan loan modifications, track what’s current, and maintain a complete record of every change — all without losing sight of a single detail.

Whether it’s generating tax forms, building custom reports, administering funds, or producing statements, Baseline makes in-house servicing intuitive and low-maintenance.

Reports including 1098/1099 are automatically prepared with accurate loan data, ready for distribution to borrowers and investors.

For every loan and contact. Review past activity, balances, and terms at any point in time—without digging through files.

Select the data points you need and export tailored reports instantly, with the flexibility to fit your workflow.

Every balance, fee, and interest charge is calculated for you—so you can close loans quickly and without errors.

See deposits, disbursements, and balances clearly, and keep every loan account accurate.

Keep your borrowers and investors informed without the hassle.

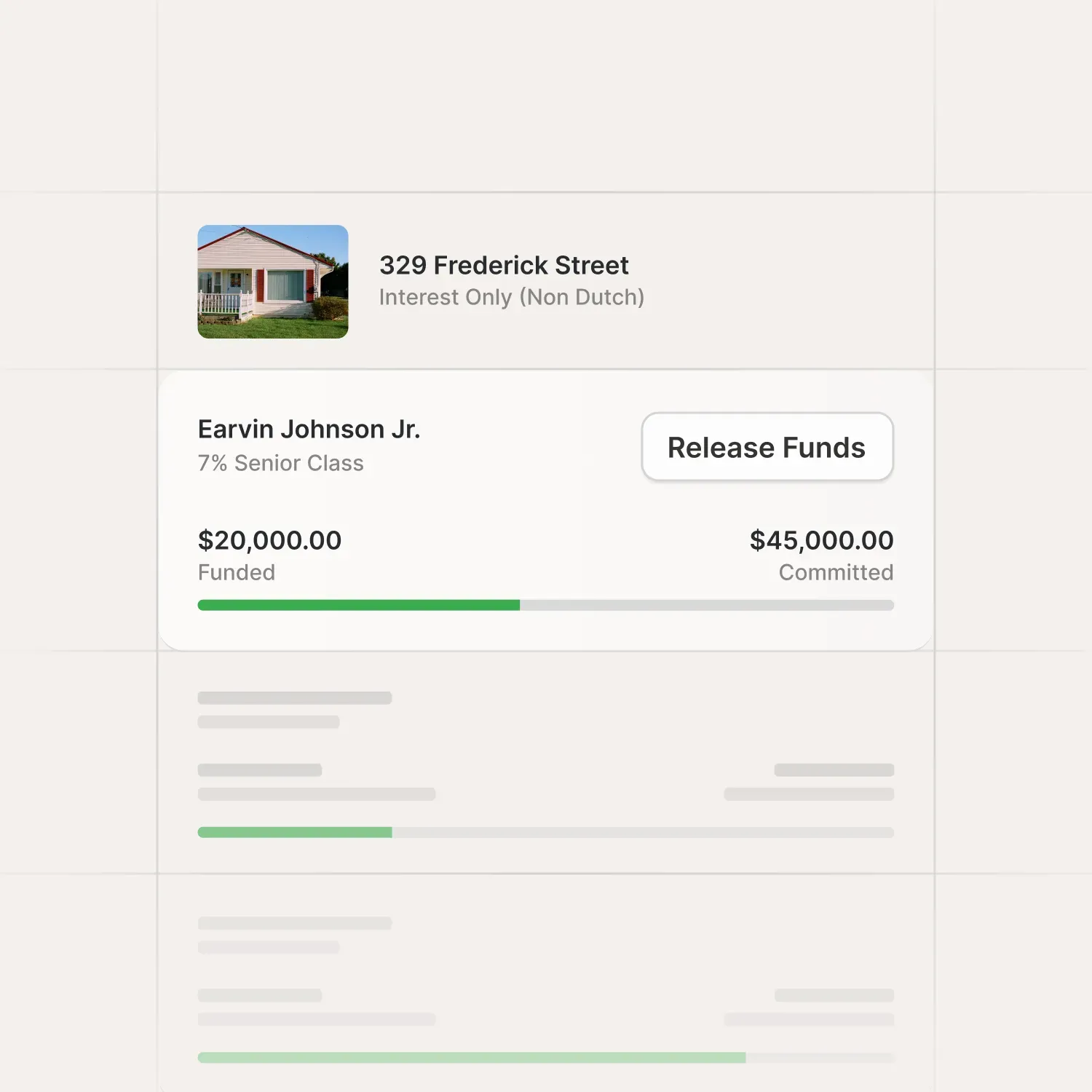

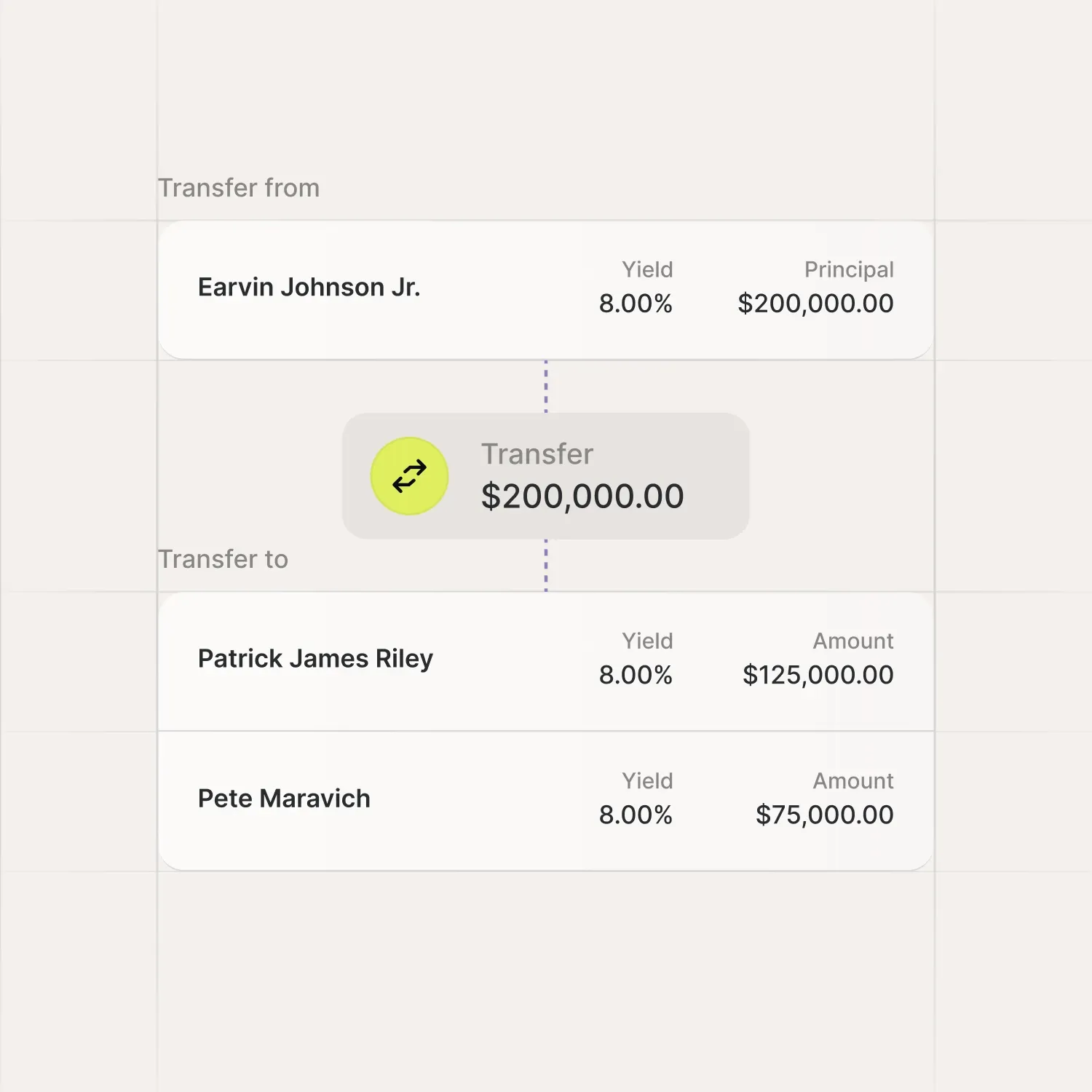

Track contributions, reallocate capital, manage distributions, and support both fractional and whole-note investors—all in one place without the hassle of spreadsheets.

Yes. We offer a robust, fully documented API that allows you to integrate Baseline with your existing systems, automate workflows, and access key data programmatically.