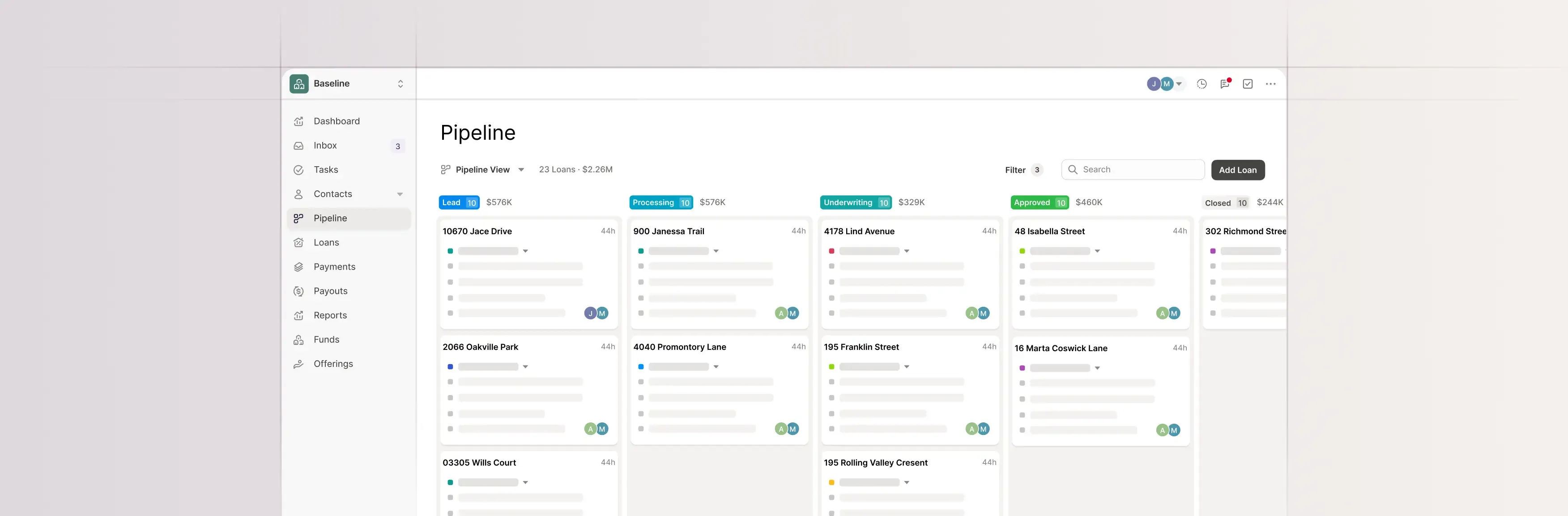

Stay organized and in control from intake to close. Know where every loan stands — and what needs to happen next.

Automations, templates, and task-driven flows help your team move deals forward with accuracy and confidence.

Built-in communication and visibility keeps your entire operation aligned and accountable.

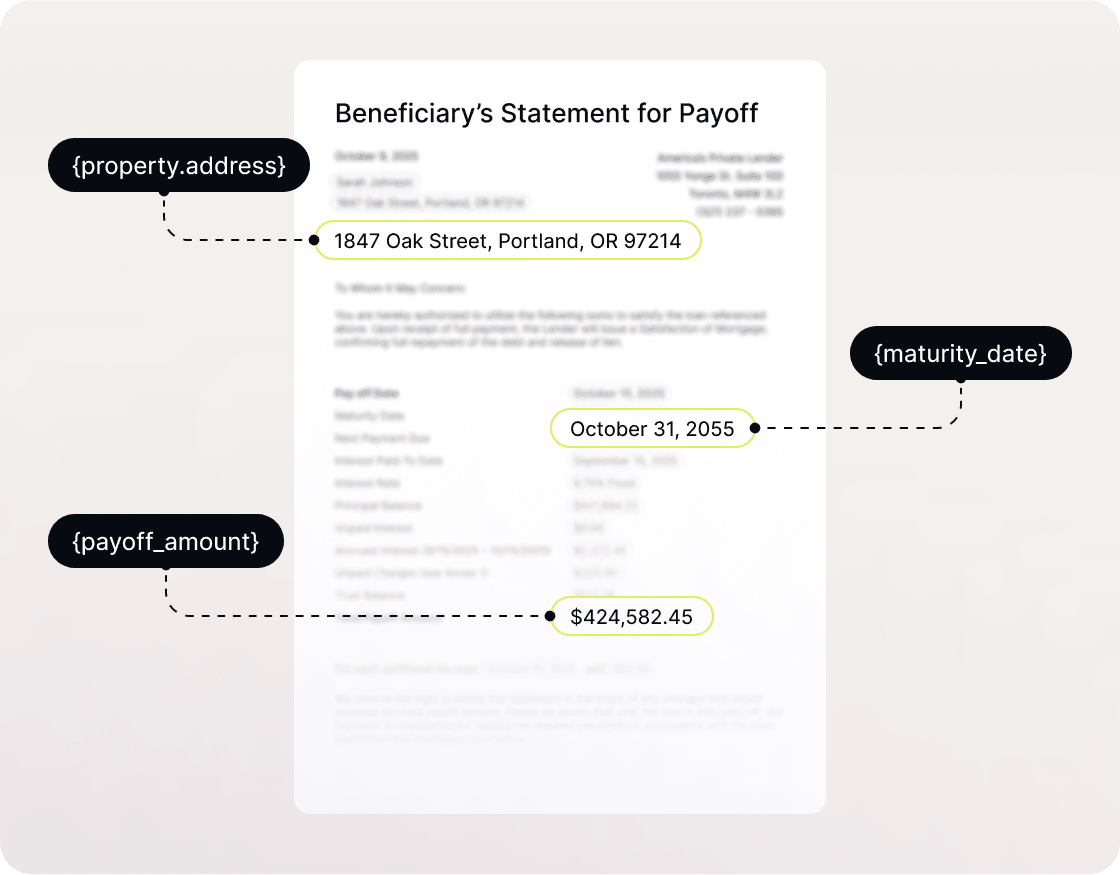

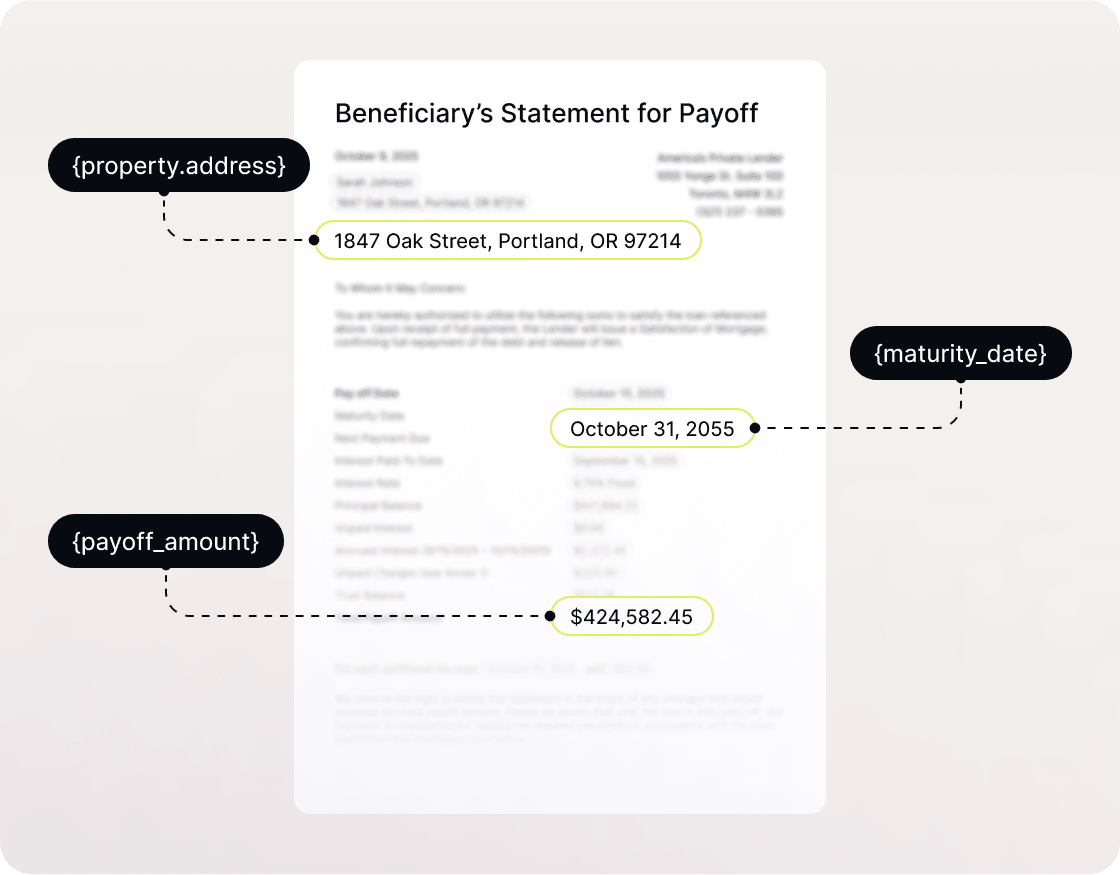

Prepare all your loan documents in seconds with document templates that automatically pull in accurate data from your loans.

Prepare all your loan documents in seconds with document templates that automatically pull in accurate data from your loans.

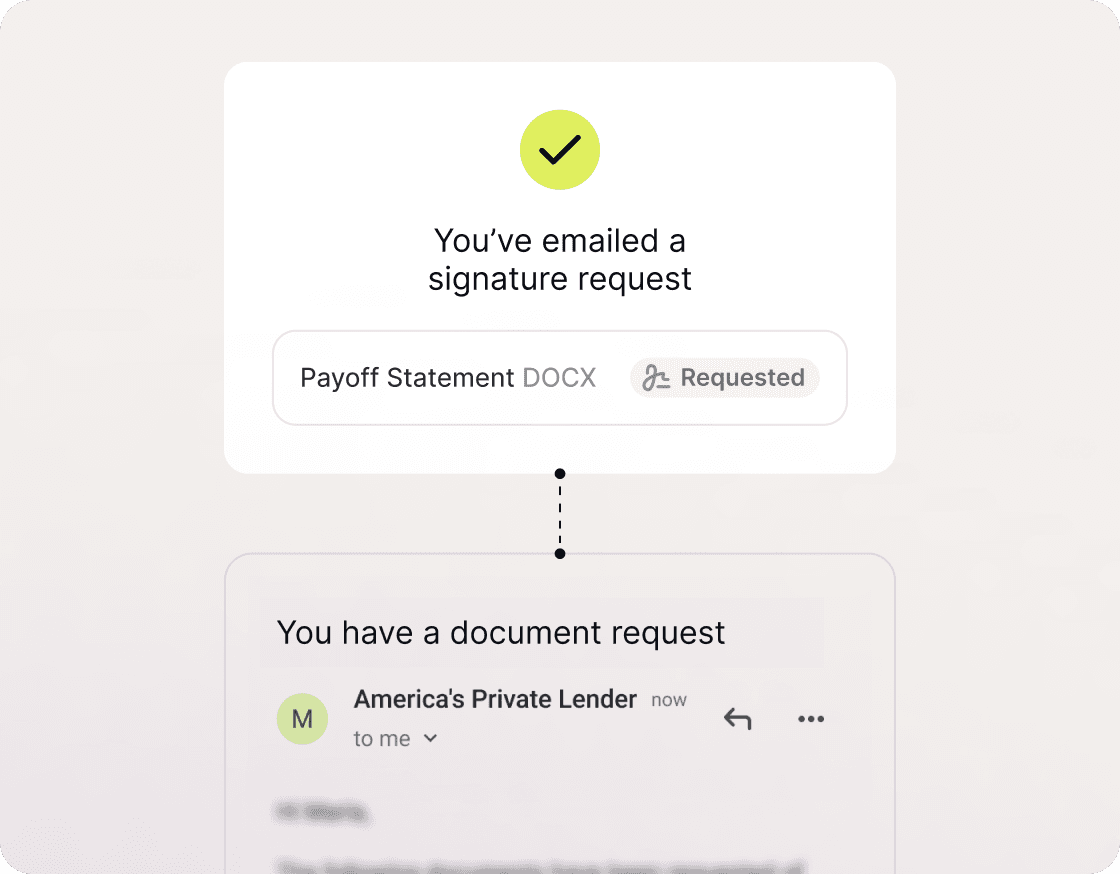

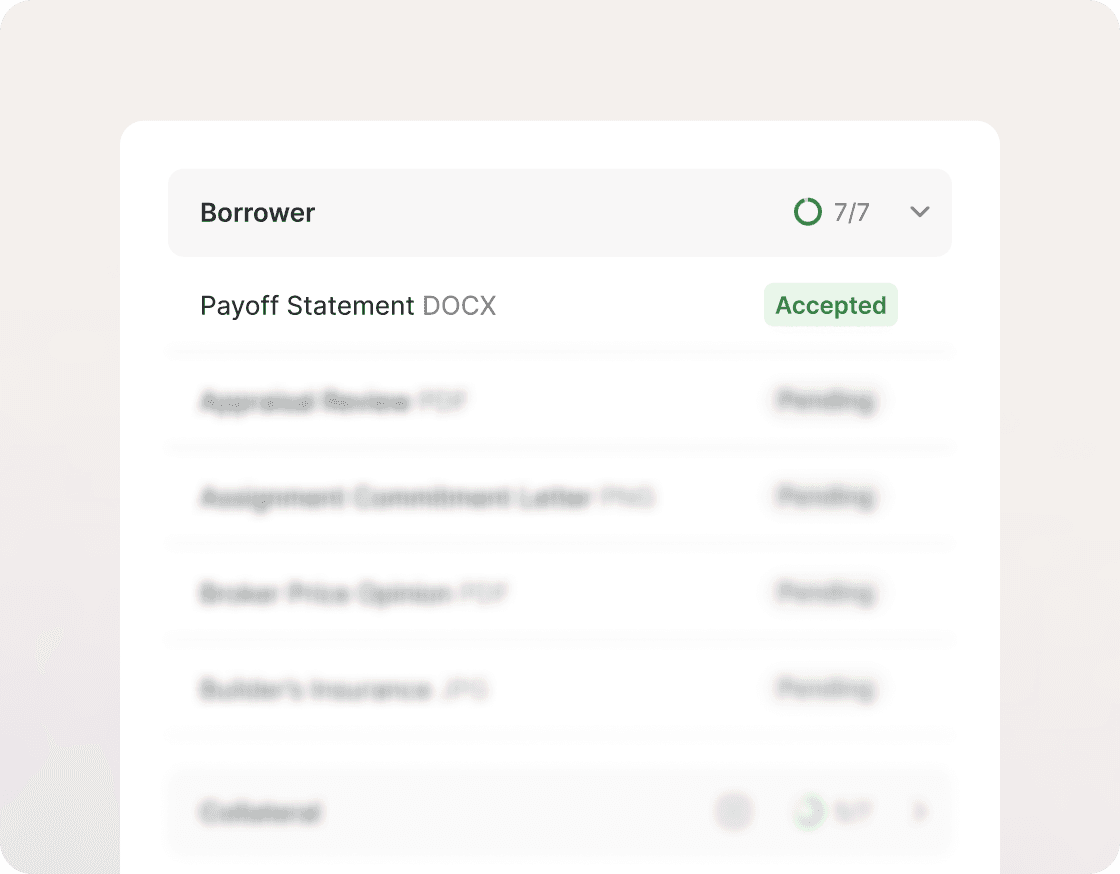

Request specific documents from borrowers with just a few clicks. Borrowers are notified and you get a live view as they complete your requests.

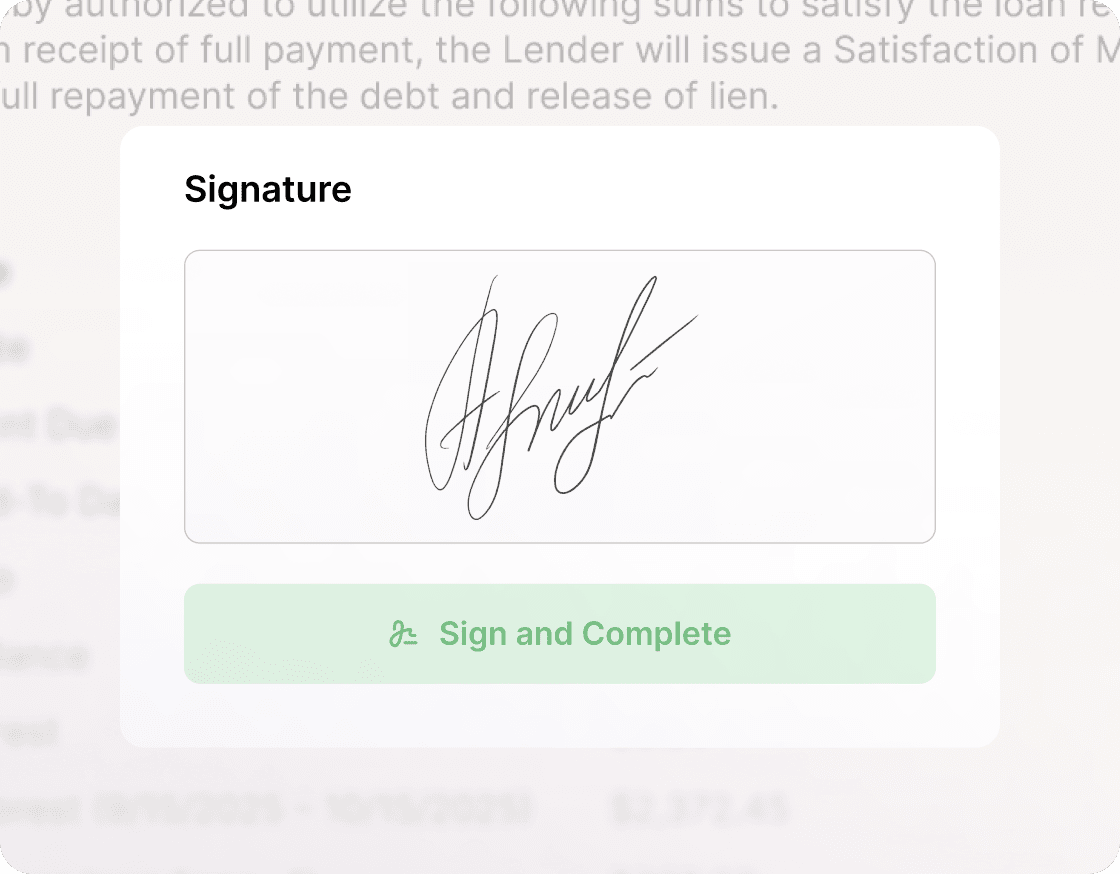

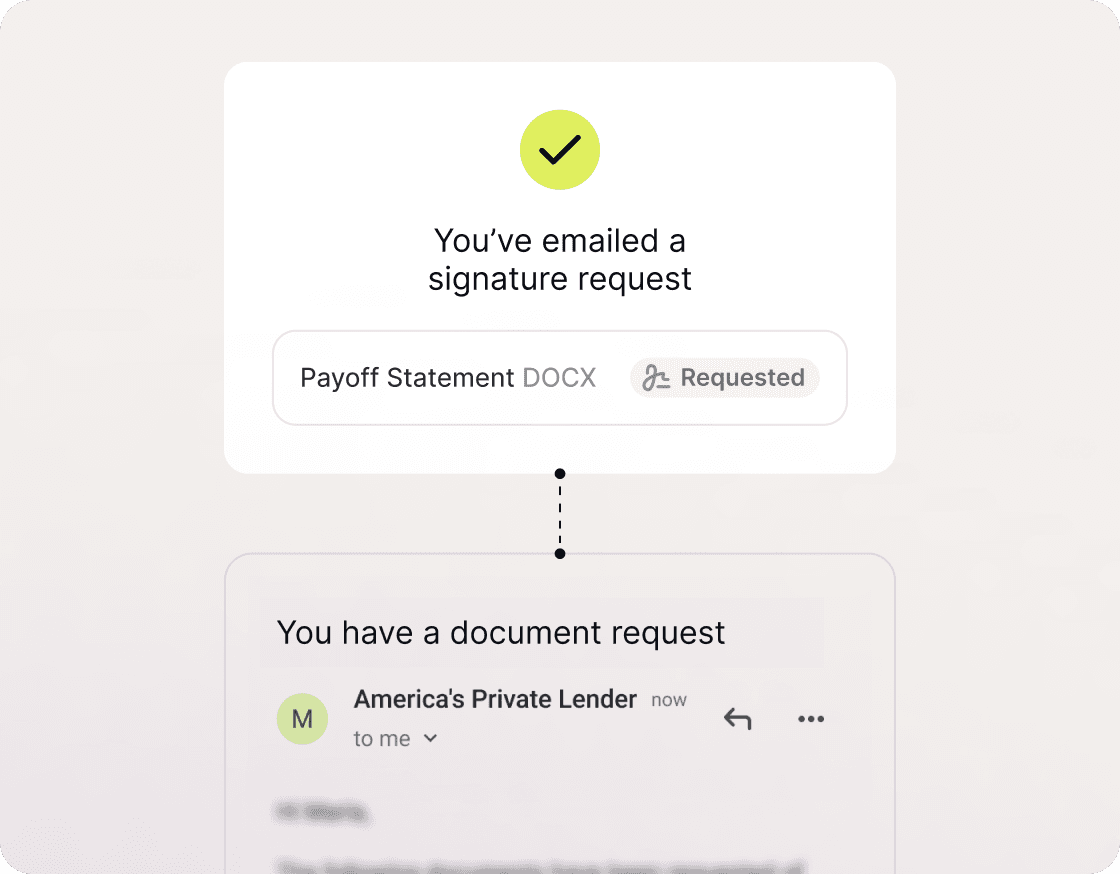

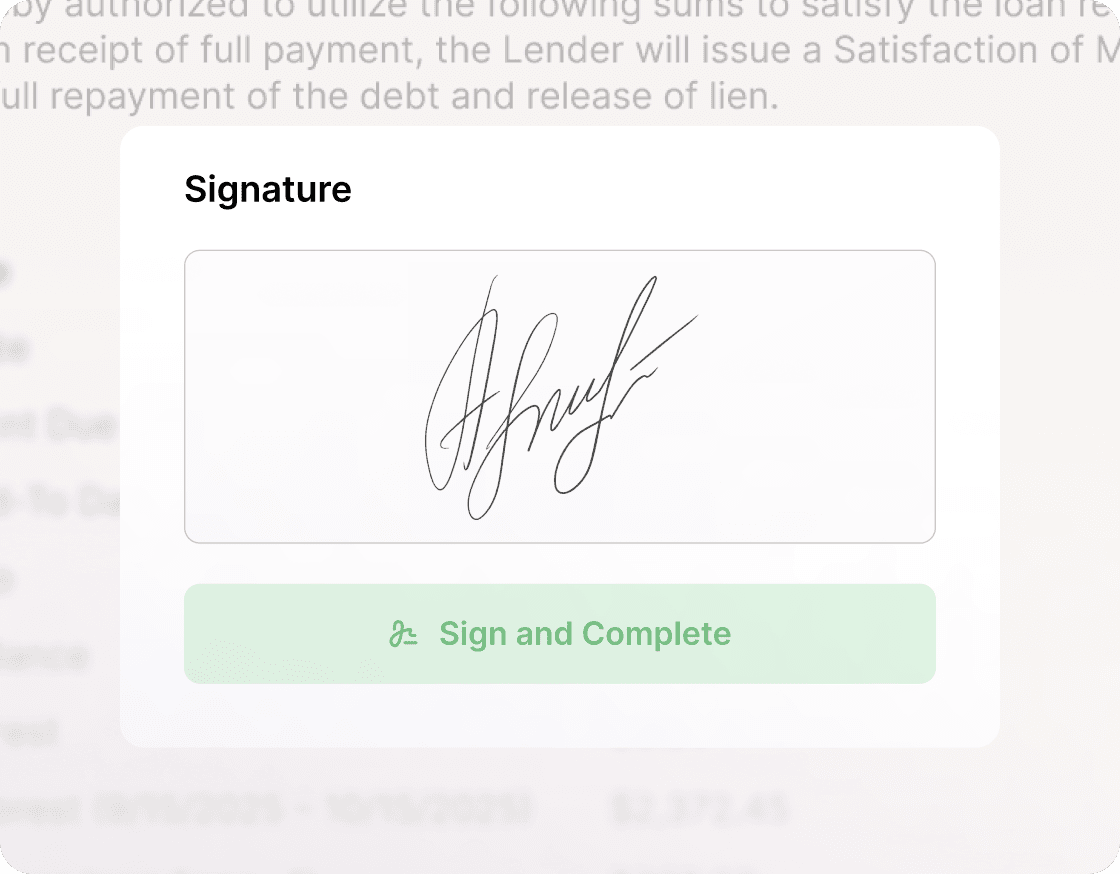

Sign and send documents for signature without needing to leave Baseline. Get notified when all parties have signed a document.

Baseline organizes your documents within your loans and across your contacts, making them easy to access wherever you are. Versioning makes it easy to update documents without losing sight of the past.

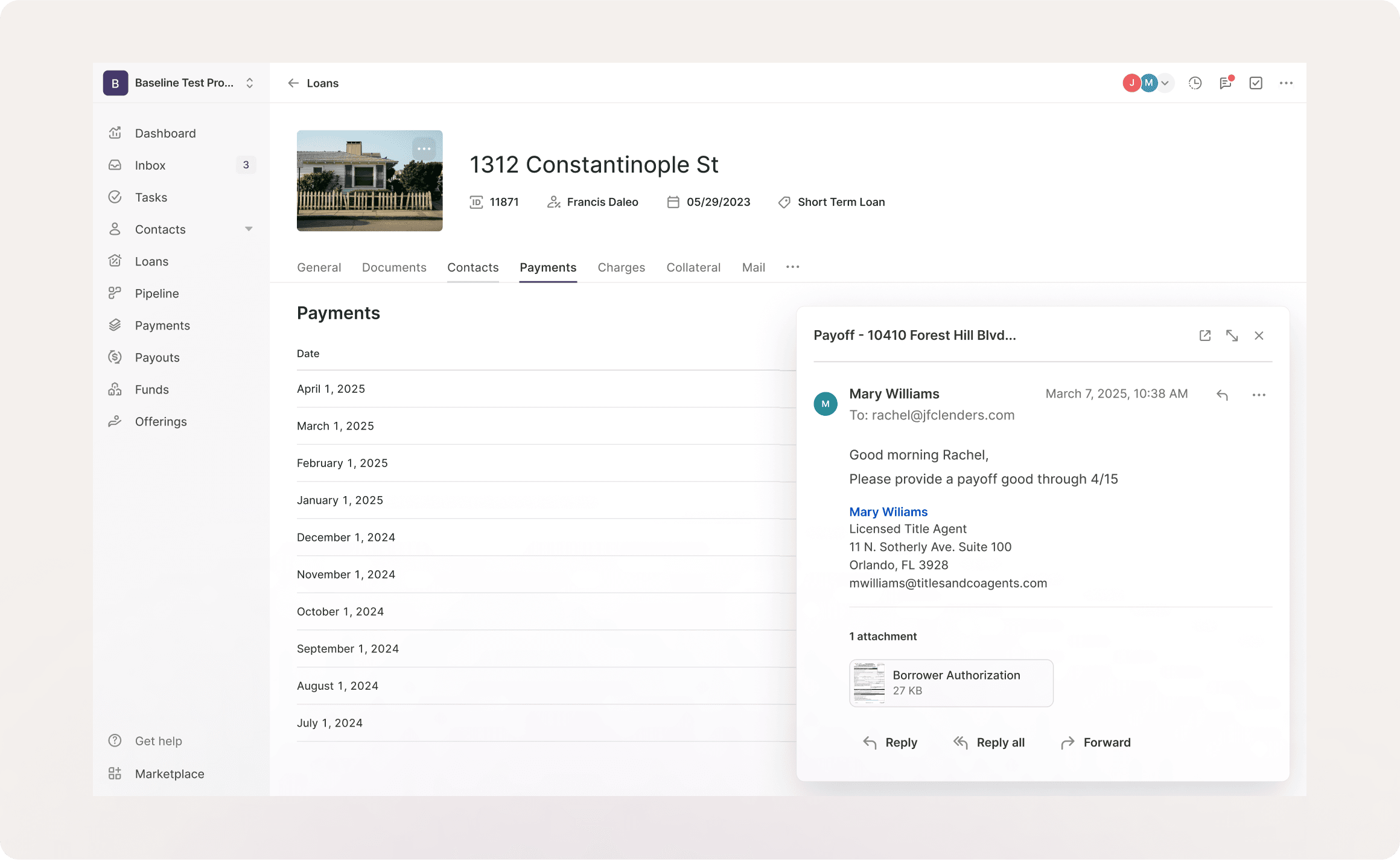

Send accurate, personalized emails with ease — without ever having to switch tabs, upload attachments or copy and paste.

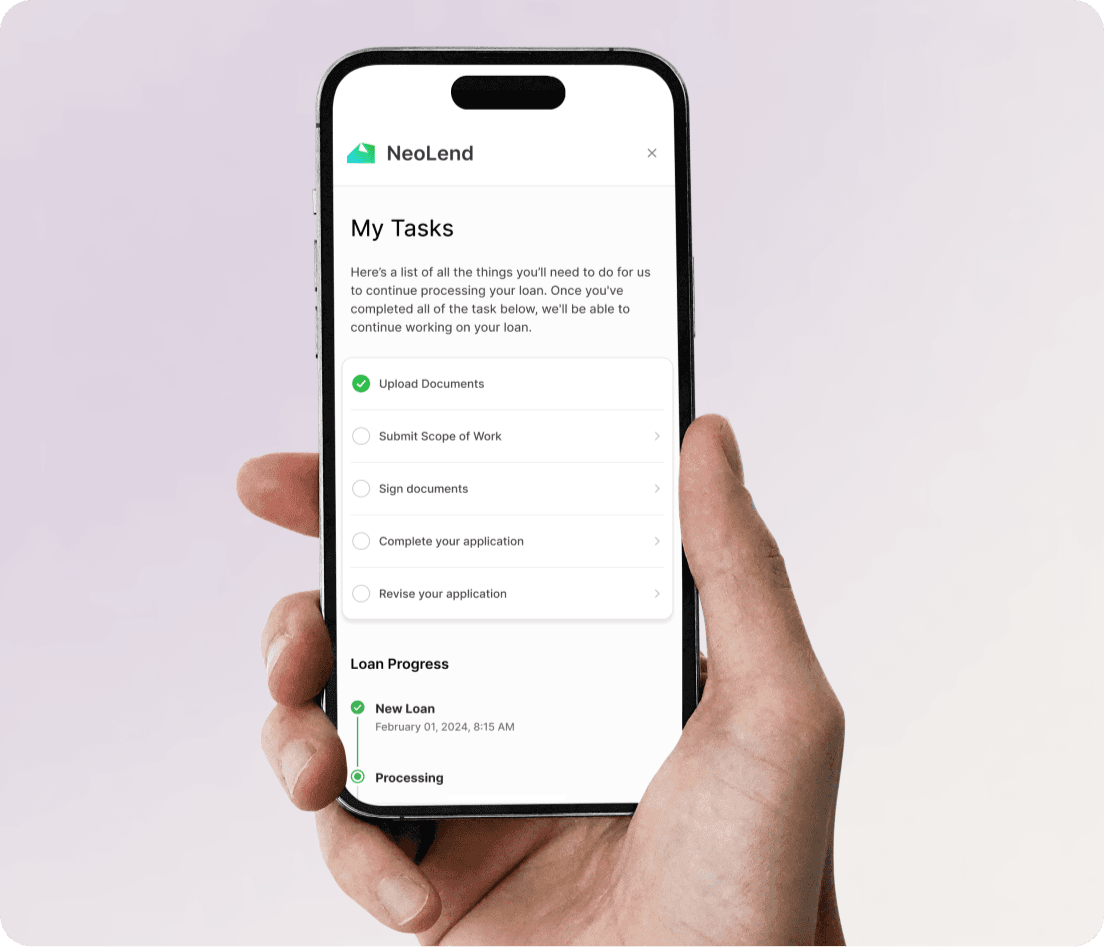

With Baseline, your branded portal guides borrowers through tasks like uploading documents, signing forms, and submitting scopes of work — so you get what you need without the back-and-forth.

Give your team a real-time view of every loan in flight — with automations, tasks and comments that keep work moving without the scramble.

Set automations to request documents, assign tasks, and notify the right people — so your team can focus on what matters.

Assign clear tasks at every stage so your team knows exactly what to do, when to do it, and who’s on point.

Collaborate directly on the loan file with internal comments — no more lost emails or out-of-context chats.

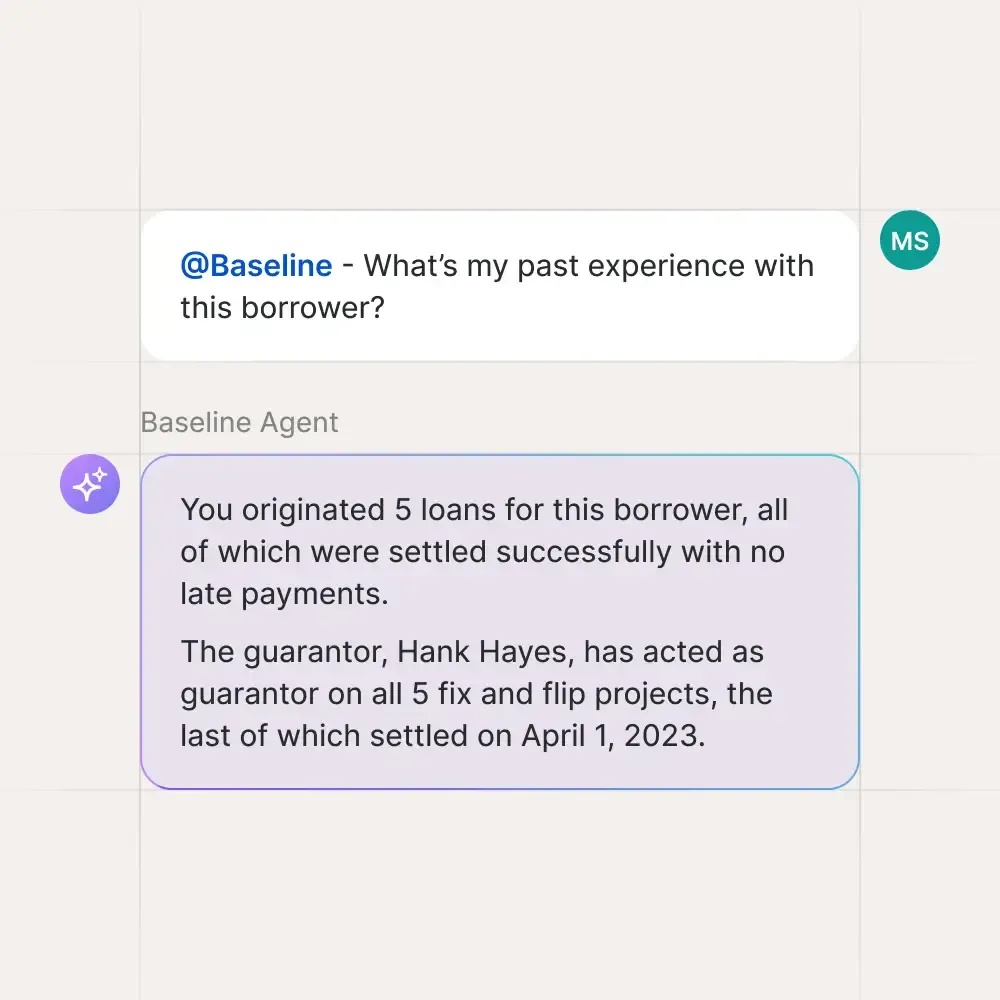

Your AI assistant lives right inside the platform—ready to answer questions, surface insights, and handle the details so you can focus on deals. It knows every loan, every borrower, and every payment history. All you need to do is ask.

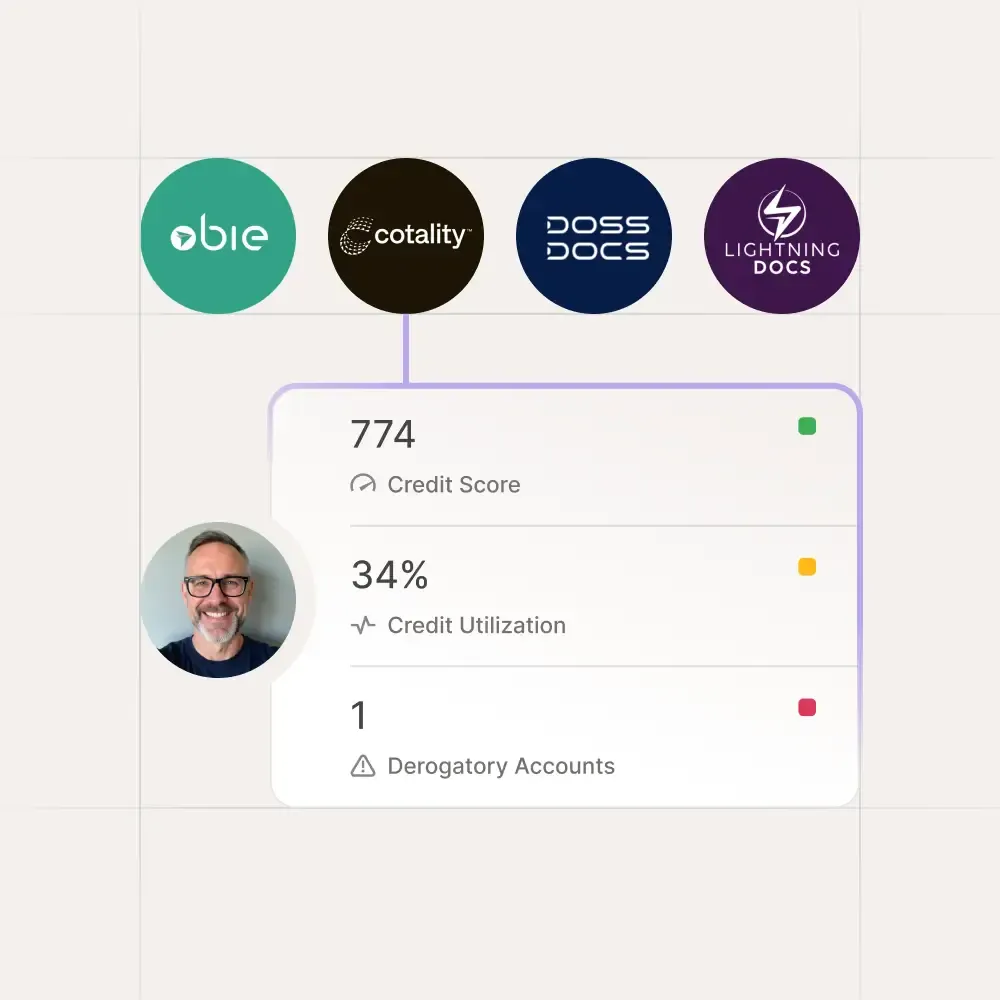

Speed up every step with real-time access to third-party services — without ever leaving the platform.

Yes. We offer a robust, fully documented API that allows you to integrate Baseline with your existing systems, automate workflows, and access key data programmatically.